Financials

Quarterly Report For The Financial Period Ended 30 June 2025

![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

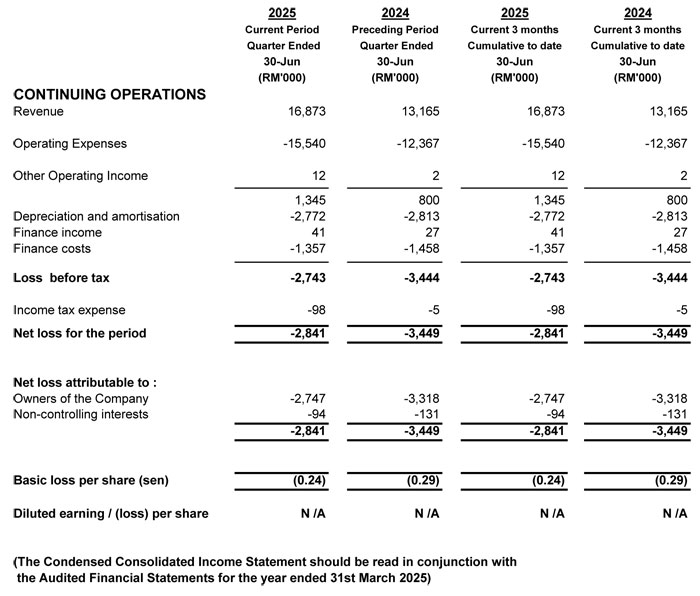

Condensed Consolidated Statements Of Profit Or Loss

For The Year Ended 30 June 2025

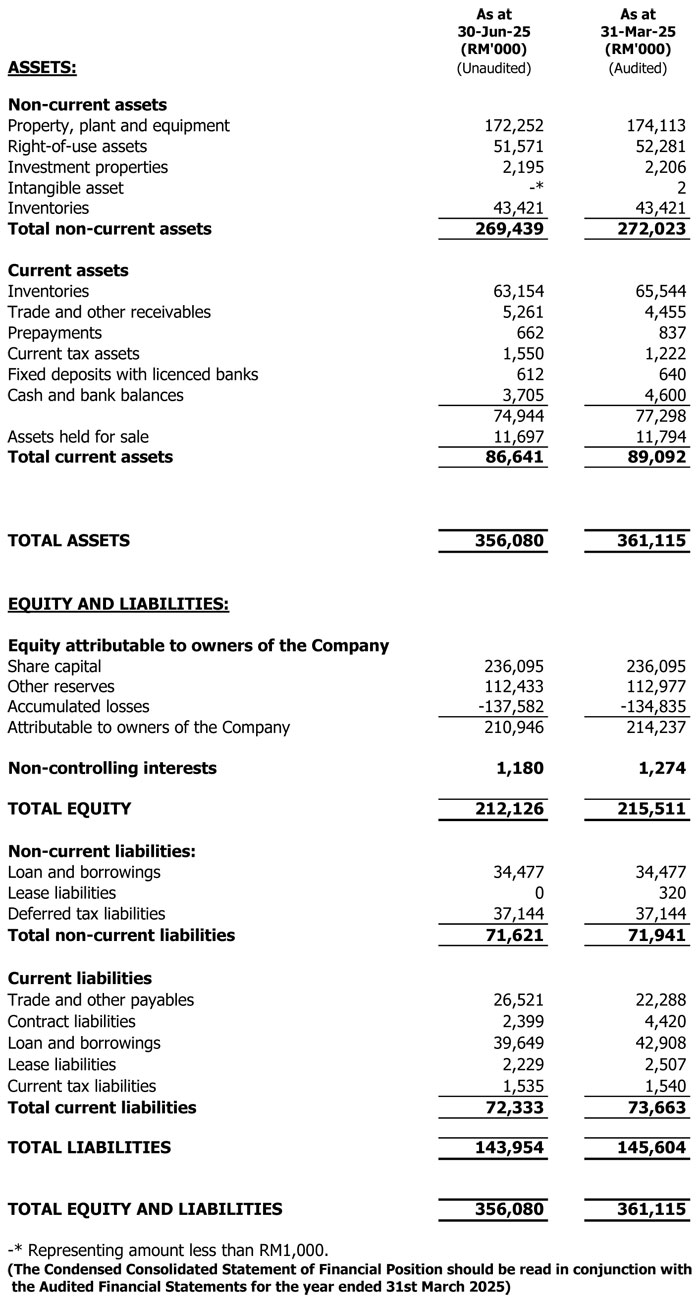

Condensed Consolidated Statement Of Financial Position

As At 30 June 2025

Financial Information